Strong January, but chips are down for car makers

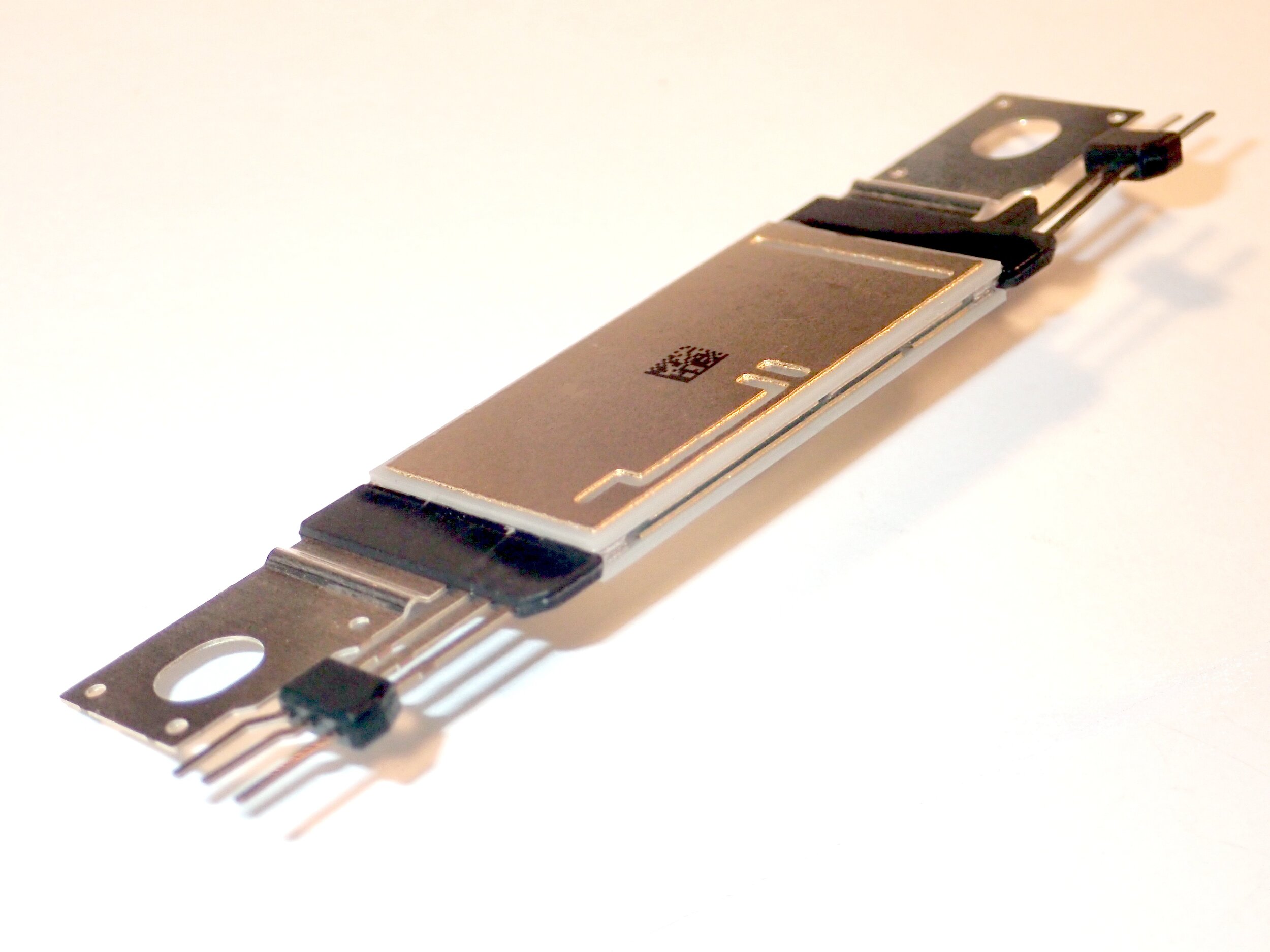

/A shortage of semiconductors is significantly impacting the world’s car makers.

Toyota Hilux enjoyed another strong month, though overshadowed - yet again - by Ford’s Ranger.

NEW vehicle sellers made a strong start to the year – but some in the industry wonder if troubles lay ahead.

The Motor Industry Association, which represents distributors, is positive about last month’s tally of 13,893 new passenger vehicle registrations – citing it as being up 6.2 percent on the same month of 2019 and the third most successful January for car purchases.

Individual brands are celebrating bonanza returns, most particularly Mitsubishi Motors New Zealand which cites the sale of 1403 of its vehicles – 1002 being passenger models and the remainder Express vans and Triton utilities – as being a 30-year peak.

MIA chief executive David Crawford says the overall industry count suggests huge promise after more than six months of speculation about whether the local motoring industry has ‘turned a corner’ since its big losses during the Covid-19 pandemic’s numerous lockdowns.

He concedes, though, that January’s result was buoyed by “comfortable amounts” of supply arriving, much of which comprised backorders from previous months.

One industry involver, who declined to be identified, believes January, this month and perhaps March might be the best months of the year.

From there on, he believes, most if not all distributors might start to feel the impact of a global issue for car makers around the world – the shortage of vital computer chips, particular semiconductors.

The factories making these items are now snowed under – and car assembly lines are slowing because products cannot be finished.

A global semiconductor shortage is hurting the world’s car makers.

The local commentator says car makers all around the world have been impacted.

That view is supported by overseas reports that have termed the shortage a “crisis within a crisis.”

Audi is among victims. According to media reports from Europe, it is resigned to 10,000 fewer cars in the first quarter of the year and putting more than 10,000 workers on furlough because it cannot finish cars.

Its parent company, Volkswagen, announced its own go-slow due to a lack of chips last week, alongside rivals such as Honda.

The issue pre-dates the global Covid crisis; 2020 started poorly for new car sales, particularly in Europe, so brands believed fewer components were required.

Once plants and the countries they locate in were hit, often hard, by Covid-19, many manufacturers cut their orders from the Chinese factories making computer chips.

The market has since rebounded but now the components are no longer so readily available, as suppliers switched their attention to other sectors, most notably gaming and home electronics.

Ordering new chips has proven to be a challenge.

As one overseas’ analyst explained: "Semiconductors have a broad range of applications but a very limited pool of companies capable of manufacturing the silicon.

"Demand is high, and supply is tight" and any sudden needs "can prove very difficult to accommodate".

"Modern cars are becoming computers on wheels, with an abundance of silicon required to control everything from the infotainment system to camera, radar and lidar," he said.

The demand from carmakers "competes for manufacturing capacity with smartphones, servers and a host of other segments".

And a boom in the market for devices such as PCs and new game consoles was making it doubly difficult to book manufacturing time.

Numerous brands have had to suspend production, some for days, some for weeks.

The shortages have seen Mercedes-Benz, Fiat, Ford, Honda, Nissan, Subaru and Toyota all reportedly suspend production for days or weeks at a time.

The MIA has yet to address this matter.

In comment pertaining to last month, it says most of the growth was in the passenger vehicle and SUV sector, which saw a 6.7 percent rise year on year. Commercial vehicles (a sector driven largely by utes) also increased, but by a lesser 5.1 percent.

The Ford Ranger and Toyota Hilux were the country;s most popular vehicles, respectively with 948 and 750 registrations in January.

Toyota maintained its spot as market leader, with 17 percent market share. Mitsubishi, Ford, and Kia were all trailing, on 10 per cent market share a piece.

It was also a strong month for electrified vehicles, with 1073 hybrids, 93 PHEVs and 244 pure electric vehicles sold. The strongest-selling EV was the Hyundai Kona, with 56 sales, followed by the MG ZS EV, with 49.